pmybals.pmyp.gov.pk Prime Minister PM Youth Loan Scheme 2025 Online Apply and Track Application

The Government of Pakistan has launched the Prime Minister Youth Loan Scheme 2025 to help young people start or grow their businesses. This scheme is also called the Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB&ALS). The main goal is to promote self-employment and support new ideas. It gives loans on easy terms with low markup.

This program is open for all Pakistani citizens who meet the required age and eligibility. The process to apply is simple and can be done online. In this article, you will learn full details about the scheme, loan types, eligibility, documents, and the step-by-step method to apply online. Check PM Housing Loan Scheme 2025.

pmybals.pmyp.gov.pk Prime Minister PM Youth Loan Scheme 2025

The Prime Minister Youth Loan Scheme 2025 is made to encourage entrepreneurship. Many young people in Pakistan have skills and ideas but do not have money to start a business. This program solves that problem by giving them access to loans without complicated conditions.

It also helps farmers and those working in agriculture. By providing easy loans, the government aims to create more jobs, increase income, and improve the economy of the country.

Who Can Apply for pmybals.pmyp.gov.pk Prime Minister PM Youth Loan Scheme 2025?

This scheme is open to all Pakistani residents. The basic rules for eligibility are simple:

- Age must be between 21 and 45 years.

- For IT and E-commerce businesses, the minimum age limit is 18 years.

- You must have a valid Computerized National Identity Card (CNIC).

- Applicants must show interest or ability in business or agriculture.

Whether you are a student with an idea, a farmer wanting better tools, or a young person planning to start a shop, this scheme is made for you.

Loan Tiers and Markup Rates

The loan is divided into three parts called tiers. Each tier has different amounts and markup rates.

Tier 1

- Maximum loan: Rs. 0.5 million (5 lakh)

- Markup: 0% (completely interest-free)

This tier is best for very small businesses or startups. Many students or home-based businesses can benefit from this.

Tier 2

- Loan amount: Above Rs. 0.5 million up to Rs. 1.5 million

- Markup: 5%

This tier is suitable for small shops, traders, or people who need more capital to expand their business.

Tier 3

- Loan amount: Above Rs. 1.5 million up to Rs. 7.5 million

- Markup: 7%

This is for larger businesses or agricultural projects. Farmers who need tractors, machines, or big investments can apply under this tier.

Partner Banks

The loans are offered through 15 Commercial, Islamic, and SME banks across Pakistan. These banks work with the government to provide loans directly to approved applicants. This makes the process simple and safe.

Some well-known partner banks include:

- National Bank of Pakistan (NBP)

- Bank of Punjab (BOP)

- Habib Bank Limited (HBL)

- United Bank Limited (UBL)

- Allied Bank Limited (ABL)

- Meezan Bank

Applicants can choose a bank near them when applying.

Documents Required

To apply, you need to provide some basic documents. These include:

- CNIC (Computerized National Identity Card)

- Educational certificates (if available)

- Business plan or idea (simple explanation of your project)

- Bank account details

- Proof of income or farming background (if any)

- Recent passport-size photo

The exact list may change depending on the bank, but the main requirement is to prove your identity and business plan.

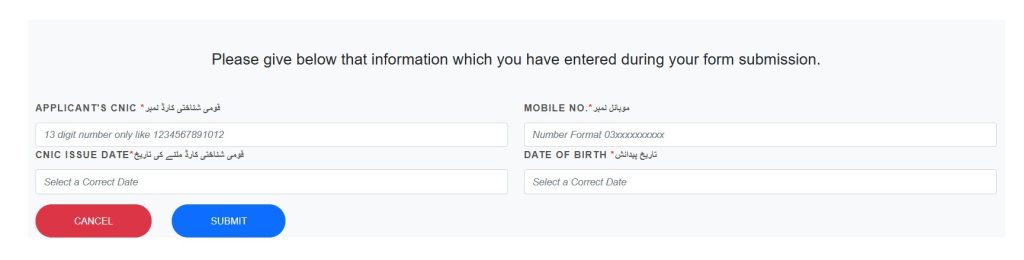

Track PM Youth Loan Scheme 2025 Application Online

The Government of Pakistan has made it easy for applicants to track the status of their loan applications online. After you submit your form for the Prime Minister Youth Business and Agriculture Loan Scheme (PMYB&ALS), you can check whether it is accepted, under review, approved, or rejected.

The tracking system requires some basic details. Below is a simple guide.

Step 1: Open the Official Portal

Go to the official website of the PM Youth Loan Scheme. Look for the option that says “Track Application” or “Check Status.”

Step 2: Enter Applicant’s CNIC

You will see a box asking for your CNIC (Computerized National Identity Card) number.

- Enter your 13-digit CNIC number without any dashes or spaces.

- Example:

1234567890123

This CNIC must be the same one you used while applying.

Step 3: Provide CNIC Issue Date

Next, select the CNIC issue date.

- This date is written on the front of your CNIC card.

- Choose the exact date from the calendar option.

Step 4: Enter Mobile Number

Now type your mobile number.

- Format must be:

03xxxxxxxxx - Use the same mobile number that you gave in the loan form.

This step helps the system verify your identity.

Step 5: Enter Date of Birth

Select your date of birth from the date box.

- Make sure it matches your CNIC record.

- Wrong date will stop the system from showing your result.

Step 6: Submit the Form

After entering all four details:

- CNIC number

- CNIC issue date

- Mobile number

- Date of birth

Click the Submit button.

Step 7: Check Your Loan Status

Once you press Submit, the system will show your application status. It can be:

- Submitted – Your application is received.

- Under Review – Bank is checking your details.

- Approved – Your loan has been accepted.

- Rejected – Application is not approved.

- Pending Documents – You may need to provide more papers.

Important Tips

- Enter details exactly as you gave in your original loan form.

- Double-check your CNIC issue date and mobile number.

- If you see an error, try again with correct information.

- If the issue continues, contact the bank or helpline given on the portal.

How to Apply Online at pmybals.pmyp.gov.pk for Prime Minister PM Youth Loan Scheme 2025

The Prime Minister Youth Loan Scheme 2025 allows only online applications. No manual forms are accepted. The process is simple and can be done at home using a computer or mobile phone.

Step 1: Visit the Official Website

Go to the official loan scheme website. Only online forms are accepted through this portal.

Step 2: Create an Account

Register yourself with your CNIC number, email, and phone number. Make sure your phone is active as you will receive confirmation codes.

Step 3: Fill the Application Form

Complete the online form carefully. Enter your personal details, business plan, and preferred bank. Check all information before submitting.

Step 4: Upload Documents

Scan and upload the required documents, including CNIC and photo. If you have a business plan written, upload that too.

Step 5: Submit the Form

After filling the details, submit the form online. You will get a tracking number to check your application status later.

Step 6: Bank Verification

The bank you selected will contact you. They may ask for more details or documents. Once approved, the loan amount will be transferred to your account.

Business Sectors Covered

This scheme supports different types of businesses. Some common sectors include:

- Small shops and traders

- Agriculture and farming

- Livestock and dairy farming

- IT and E-commerce businesses

- Service providers like salons, tailoring, workshops

- Manufacturing and small-scale industries

Both men and women are encouraged to apply. Women entrepreneurs are especially supported to start home-based or online businesses.

Benefits of the Scheme

The PM Youth Loan Scheme 2025 comes with many benefits:

- Easy loan with simple rules

- Very low markup compared to market rates

- Zero interest for loans up to Rs. 0.5 million

- Wide range of business and agriculture support

- Online application system

- Equal opportunity for men and women

- Helps reduce unemployment and poverty

This program is a golden chance for people who have ideas but no money to start.

Important Points to Remember

- Applications are only accepted online.

- Double-check your details before submission.

- Keep your CNIC and other documents valid and up to date.

- Prepare a simple but clear business plan.

- Choose the right tier according to your need.

FAQs About PM Youth Loan Scheme 2025

Q1: Can a student apply for this scheme?

Yes, students can apply if they are at least 18 years old and have a business idea.

Q2: What is the maximum age limit?

The maximum age is 45 years.

Q3: Is there any guarantee required?

For small loans under Tier 1, usually no guarantee is needed. For larger amounts, banks may ask for some security.

Q4: Can women apply for the loan?

Yes, women are encouraged to apply. There is no restriction.

Q5: How much time does it take to get approval?

It depends on the bank, but usually the process takes a few weeks.

Q6: Is it possible to apply without a business plan?

No, a simple business idea or plan is required. It does not have to be very detailed, but it should explain your project.

Q7: Can I apply if I already have a loan from another bank?

Yes, but your repayment history will be checked. If you have unpaid loans, your new application may not be approved.

Final Words

The Prime Minister PM Youth Loan Scheme 2025 is a big step to help the youth of Pakistan. It gives financial support to start small businesses, expand shops, or improve farming. With easy terms and online applications, this scheme is open for all. If you have a good idea and want to make a change in your life, this is the right time to apply.