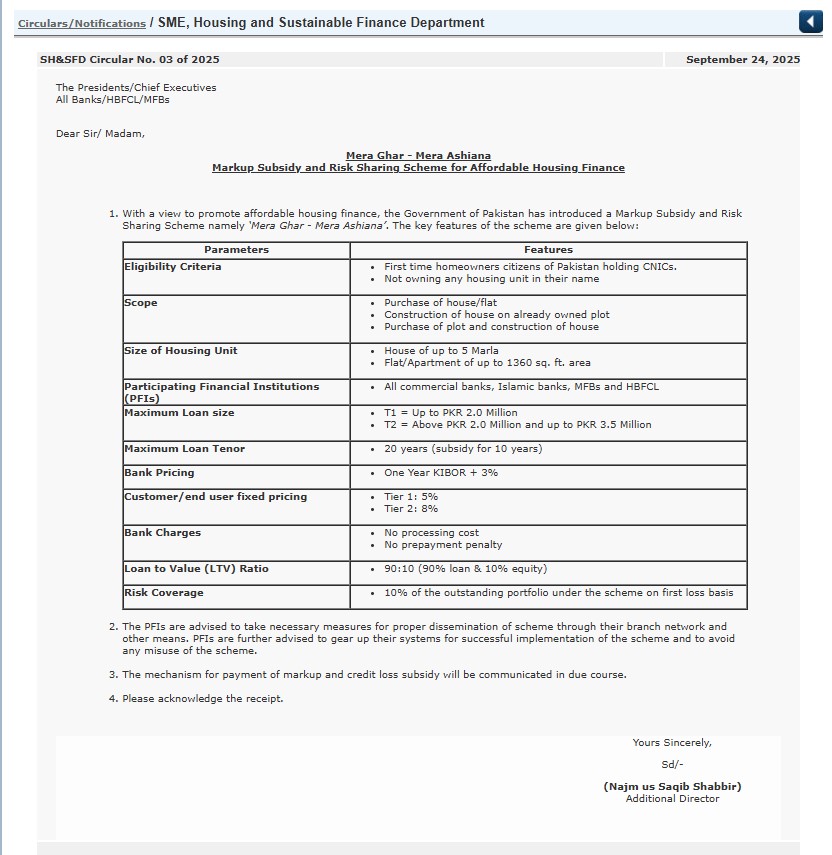

Mera Ghar Mera Ashiana Loan Scheme 2025 by SBP State Bank of Pakistan

The Mera Ghar Mera Ashiana Loan Scheme is a special housing finance program introduced by the Government of Pakistan and supervised by the State Bank of Pakistan (SBP). It has been designed to help low and middle-income families buy or build their first home. In 2025, this scheme continues to provide support through low markup rates, risk sharing, and long repayment options.

This guide explains everything you need to know about the Mera Ghar Mera Ashiana Loan Scheme, including eligibility, scope, loan size, repayment terms, participating banks, and step-by-step application process. By the end of this article, you will have a complete understanding of how this scheme works and how you can benefit from it.

Introduction to the Mera Ghar Mera Ashiana Loan Scheme 2025

Finding a home has always been a challenge for families in Pakistan. The rising cost of land and construction makes it difficult for first-time buyers to own a house. To solve this problem, the government launched the Mera Ghar Mera Ashiana Loan Scheme.

In many cases, applicants may also be required to provide basic documents such as identity proof and Police clearance to ensure transparency and security in the loan approval process.

The scheme is based on markup subsidy and risk sharing. It lowers the cost of borrowing by fixing the markup for end users at affordable rates. Banks and microfinance institutions are part of this plan, which makes it easy for citizens to apply through their nearest branch.

Eligibility Criteria of Mera Ghar Mera Ashiana Loan Scheme 2025

The scheme is only for first-time homeowners. To qualify:

- You must be a citizen of Pakistan with a valid CNIC.

- You must not own any house, flat, or property in your name.

- You should meet the loan requirements of the bank, such as income proof and repayment ability.

This means the scheme is focused on helping families who do not have a home yet and want to buy or build one for the first time.

Scope of the Loan

The Mera Ghar Mera Ashiana Loan Scheme covers different housing needs. You can apply for a loan in the following cases:

- Purchase of a house or flat (ready for living).

- Construction of a house on an already owned plot.

- Purchase of a plot and construction of a house on it.

This makes the scheme flexible. Whether you want to buy, build, or construct on your own land, the facility is available.

Size of Housing Unit

The government has set a clear size limit to keep the scheme focused on affordable housing:

- House: Up to 5 Marla.

- Flat/Apartment: Up to 1,360 square feet.

This ensures that the facility is used for small and medium homes instead of luxury properties.

Participating Banks and Institutions

Almost all commercial banks, Islamic banks, Microfinance Banks (MFBs), and House Building Finance Corporation Limited (HBFCL) are part of the scheme.

This wide participation means you can approach any major bank branch near you to apply. Banks have been directed by SBP to guide applicants and speed up the process.

Loan Size

The scheme is divided into two tiers depending on the loan amount:

- Tier 1 (T1): Up to PKR 2.0 million.

- Tier 2 (T2): Above PKR 2.0 million and up to PKR 3.5 million.

This structure helps small borrowers as well as families who need a slightly bigger loan for construction or purchase.

Loan Tenure

The maximum loan period is 20 years. However, the subsidy is available for the first 10 years.

This long repayment period reduces the monthly burden. Families can pay smaller installments over many years instead of facing heavy payments in a short time.

Markup Rates

One of the most attractive features of the Mera Ghar Mera Ashiana Loan Scheme is the fixed markup rate for borrowers:

- Tier 1: 5% fixed.

- Tier 2: 8% fixed.

Banks normally charge higher rates based on the One Year KIBOR + 3%, but due to subsidy, the end user only pays 5% or 8%. This makes housing finance affordable for low and middle-income families.

Loan to Value (LTV) Ratio

The scheme follows a 90:10 ratio, which means:

- 90% of the property value is financed by the bank.

- The customer only pays 10% as equity or down payment.

This low requirement for personal investment makes it possible for families with limited savings to own a home.

Bank Charges

Banks have been instructed not to burden applicants with extra costs. Therefore:

- No processing cost is charged.

- No prepayment penalty applies if you repay early.

This helps reduce the overall cost of the loan.

Risk Coverage

The scheme also provides risk protection to banks. 10% of the outstanding portfolio is covered by the government on a first-loss basis.

This means that if there are defaults, the banks are protected. As a result, banks feel safe to issue more housing loans to first-time homeowners.

Payment Terms

Let’s break down the payment structure for better understanding:

- If you borrow PKR 2 million at 5% for 20 years, the monthly installment will be much lower compared to normal market rates.

- If you borrow PKR 3.5 million at 8% for 20 years, you still get affordable monthly payments due to subsidy.

Since the loan tenure is long, families can plan their finances easily. Paying rent can often be more expensive than paying installments under this scheme.

Mera Ghar Mera Ashiana Loan Scheme 2025 Registration Process

Here is how you can apply for the Mera Ghar Mera Ashiana Loan Scheme:

- Visit a participating bank branch with your CNIC.

- Ask for the Mera Ghar Mera Ashiana Loan application form.

- Provide documents such as CNIC, proof of income, salary slips, or business records.

- Submit property documents if you are buying or constructing.

- The bank will check your eligibility and calculate the loan amount.

- After approval, the loan will be issued, and payments will start as per your plan.

Benefits of the Scheme

The scheme offers several clear benefits:

- Affordable markup rates of 5% and 8%.

- Long repayment period up to 20 years.

- Small down payment (only 10%).

- No hidden bank charges.

- Support for both purchase and construction.

- Protection for banks to encourage more lending.

These features make it one of the most practical housing finance schemes in Pakistan.

Common Questions and Answers

Can I apply if I already own a small house?

No. The scheme is only for first-time homeowners.

Which banks are offering the loan?

All major commercial and Islamic banks, along with HBFCL and MFBs.

What if I want to repay earlier?

You can repay at any time without penalty.

Is there a limit on house size?

Yes. Houses up to 5 Marla or flats up to 1,360 sq. ft. qualify.

How much down payment is required?

Only 10% of the property value.

Role of SBP in the Scheme

The State Bank of Pakistan is responsible for monitoring the implementation of the scheme. It has directed all banks to ensure transparency, spread awareness, and avoid misuse. SBP also oversees the subsidy payments and risk-sharing arrangements with banks.

Why This Scheme Matters in 2025

Housing is a basic need. With urbanization and rising population, the demand for homes is increasing every year. Many families in Pakistan cannot afford market loans due to high markup rates.

The Mera Ghar Mera Ashiana Loan Scheme bridges this gap by reducing markup and spreading payments over many years. In 2025, this scheme is still one of the most important tools to make housing affordable for low and middle-income families.

Final Thoughts

The Mera Ghar Mera Ashiana Loan Scheme 2025 by SBP is a powerful step toward solving the housing problem in Pakistan. It provides low-cost loans, long repayment options, and strong support from the government.

If you are a first-time home buyer and meet the eligibility criteria, this scheme is an opportunity to secure your dream home with easy payments. With participation from all major banks, applying is simple and within reach for families across the country. Check Official Link of SBP Website https://www.sbp.org.pk/smefd/circulars/2025/C3.htm.