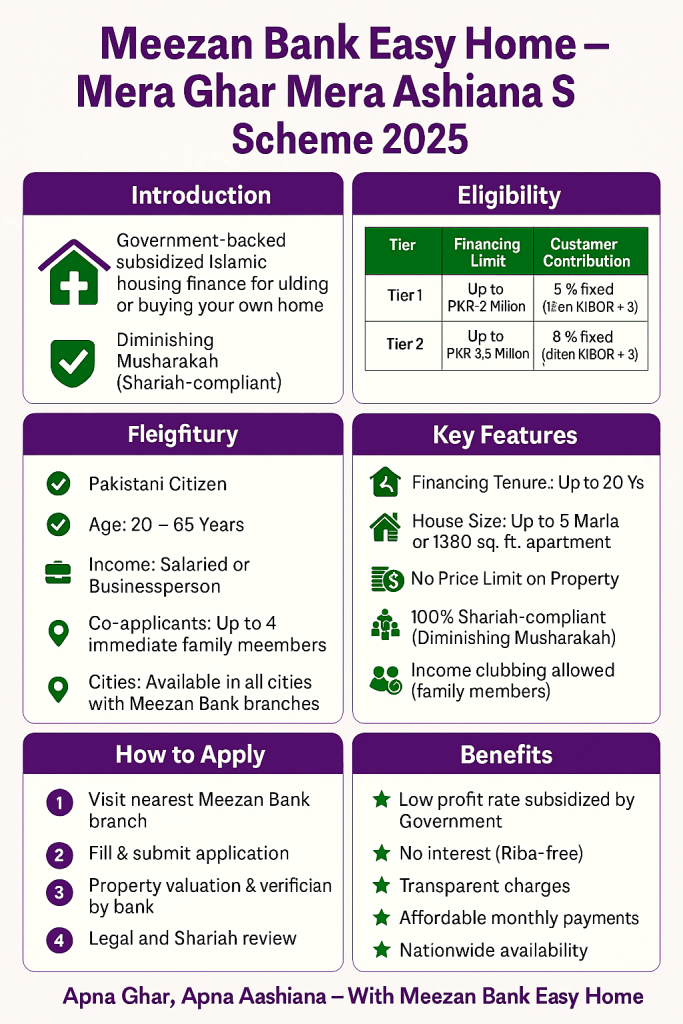

Meezan Bank Easy Home Mera Ghar Mera Ashiana Loan Scheme 2025

The Meezan Bank Easy Home – Mera Ghar Mera Ashiana (MGMA) scheme is a subsidized Islamic housing finance program introduced by the Government of Pakistan to promote affordable housing for citizens. The initiative aims to make home ownership easier for families who dream of having their own house but face financial challenges. Meezan Bank, being Pakistan’s first and largest Islamic bank, offers this facility through its Shariah-compliant product Easy Home under the Diminishing Musharakah mode of financing.

This scheme provides financing for both construction of new houses and purchase of ready-built homes or apartments. The profit rates are subsidized by the government, making it one of the most affordable home financing options available in 2025.

The Meezan Bank Easy Home Mera Ghar Mera Ashiana Scheme 2025 is a government-subsidized Islamic housing finance program launched to make home ownership affordable for Pakistani citizens. Offered through Meezan Bank’s Shariah-compliant Diminishing Musharakah model, the scheme provides financing for purchasing or constructing homes with profit rates as low as 5% for the first 10 years. Applicants can borrow up to PKR 3.5 million for a tenure of up to 20 years, contributing only 10% as a down payment. With no processing fees, flexible repayment, and eligibility for salaried and self-employed individuals across all cities, it ensures a transparent and Riba-free way to own a house in Pakistan.

Eligibility Criteria

To qualify for the Mera Ghar Mera Ashiana Loan Scheme 2025, applicants must meet the following basic eligibility conditions:

1. Citizenship

- The applicant must be a Pakistani citizen.

2. Age Requirement

- Minimum age: 20 years.

- Maximum age: 65 years or retirement age (whichever comes first) at the time of financing maturity.

3. Income Requirement

- There is no fixed minimum income for applicants from the formal sector.

- A maximum 50% Debt Burden Ratio (DBR) is applied to ensure affordability.

4. Employment / Business Experience

- Salaried individuals:

- Permanent employees must have at least 6 months of continuous work experience in the same field.

- Contractual employees must have at least 1 year of continuous employment and 2 years of total work experience in the same industry.

- Self-employed / Businesspersons:

- Must have at least 2 years of experience in the same business or industry.

5. Co-applicant Policy

- Up to four co-applicants are allowed.

- Co-applicants must be immediate family members such as spouse, parents, adult children, brothers, or sisters.

- 100% income clubbing is permitted to enhance the financing amount.

6. Eligible Cities

Available in all cities of Pakistan where Meezan Bank has branches.

Processing and Other Charges

Meezan Bank has made the process affordable by minimizing processing charges:

| Type of Charges | Salaried Individuals | Businessmen |

|---|---|---|

| Processing Charges | NIL | NIL |

| Legal Report Charges | At Actual | At Actual |

| Property Valuation Charges | At Actual | At Actual |

| Income Estimation Charges | N/A | At Actual |

| Documentation Charges | Applied at the time of signing Musharakah Agreement as per financing amount |

This structure ensures transparency and cost-effectiveness for all applicants.

Key Features of the Scheme

The Easy Home – Mera Ghar Mera Ashiana financing offers several attractive features for customers seeking Shariah-compliant home ownership solutions.

1. Financing Tiers and Rental Rates

| Tier | Maximum Financing Amount | Customer Contribution | Rental Rate |

|---|---|---|---|

| Tier 1 | Up to PKR 2 million | Minimum 10% of property value | 5% for first 10 years, then variable at KIBOR + 3% |

| Tier 2 | Above PKR 2 million to PKR 3.5 million | Minimum 10% of property value | 8% for first 10 years, then variable at KIBOR + 3% |

2. Tenure of Financing

- Maximum 20 years repayment period.

3. Size of Housing Unit

- Up to 5 Marla house or 1360 sq. ft. apartment.

4. Price Cap

- There is no capping on the maximum price of the housing unit.

5. Shariah Compliance (Diminishing Musharakah)

The scheme is based on Diminishing Musharakah, where:

- The Bank and Customer jointly own the property.

- The Bank leases its share to the customer against periodic rent.

- The Customer gradually buys the Bank’s share, becoming full owner by the end of the term.

6. Purpose of Financing

Meezan Bank offers two main financing options under this scheme:

- Easy Buyer: For purchase of a newly constructed house, flat, or apartment.

- Easy Builder:

- Type 1(A): Construction on applicant’s own land.

- Type 1(B): Purchase of land plus construction of a residential unit.

How to Apply for the Meezan Bank Mera Ghar Mera Ashiana Scheme 2025

Applying for the Easy Home Mera Ghar Mera Ashiana scheme is simple and convenient.

Visit a Meezan Bank Branch

- Visit your nearest Meezan Bank branch in any city across Pakistan.

- Ask for the Easy Home Mera Ghar Mera Ashiana application form.

Fill and Submit the Form

- Provide basic personal, employment, and property details.

- Attach copies of CNICs of applicant and co-applicants.

- Submit proof of income (salary slips, tax returns, or business documents).

Bank Assessment and Valuation

- Meezan Bank will verify documents, perform income assessment, and conduct a property valuation through approved evaluators.

Legal and Shariah Review

- Property documents are checked for clear title and Shariah compliance.

General Benefits of the Scheme

The Meezan Bank Easy Home Mera Ghar Mera Ashiana Scheme 2025 offers multiple benefits for citizens seeking affordable housing with Islamic financing principles:

Encouragement for Home Construction:

By offering separate financing for construction and purchase, the scheme supports both urban and semi-urban development.Signing of Musharakah Agreement

Government Subsidy:

The profit subsidy significantly lowers the monthly rental payments, making home ownership easier for low- and middle-income families.

Shariah-Compliant Financing:

The scheme follows Islamic principles through Diminishing Musharakah, avoiding interest-based transactions.

Affordable Monthly Payments:

The fixed subsidized rental rate for the first 10 years provides stability and predictability in payments.

Flexible Tenure:

Borrowers can select repayment periods of up to 20 years, depending on their income and preference.

Wide Availability:

The scheme is accessible across all cities where Meezan Bank operates, making it nationwide.

Transparent Charges:

With no hidden fees and NIL processing charges, the scheme ensures complete transparency for customers.

Ownership Security:

The property is co-owned with the bank initially, ensuring mutual security until full ownership transfers to the customer.

Co-applicant Income Support:

Families can combine incomes of up to four members to increase eligibility and financing power.

No Maximum Property Price Limit:

Customers can select any property size within allowed limits without a government-imposed price ceiling.

- Once approved, both parties sign the Diminishing Musharakah Agreement.

- The financing amount is disbursed, and the customer can begin construction or complete the purchase.

Conclusion

The Meezan Bank Easy Home Mera Ghar Mera Ashiana Loan Scheme 2025 is a remarkable initiative for Pakistani citizens who wish to build or buy their own homes under Islamic banking principles. Backed by the Government of Pakistan’s subsidy, this scheme provides affordable financing options, flexible repayment, and complete Shariah compliance through Meezan Bank’s trusted system.

With transparent charges, nationwide access, and long-term affordability, the program truly reflects the spirit of “Mera Ghar Mera Ashiana” turning the dream of owning a home into a reality for thousands of families across Pakistan.

Frequently Asked Questions (FAQs)

What is Meezan Bank Easy Home Mera Ghar Mera Ashiana Scheme 2025?

It is a government-subsidized Islamic housing finance program offered by Meezan Bank to help citizens buy or build their own homes through Shariah-compliant Diminishing Musharakah financing.

Who can apply for this scheme?

Any Pakistani citizen aged 20 to 65 years with a stable income (salaried or self-employed) can apply. Applicants must meet the bank’s credit and documentation requirements.

What types of properties can be financed?

You can use this scheme to:

- Buy a new house, apartment, or flat (Easy Buyer)

- Build a house on owned land or purchase land plus build (Easy Builder)

What is the maximum financing limit under this scheme?

- Tier 1: Up to PKR 2 million

- Tier 2: Up to PKR 3.5 million

What is the profit or rental rate?

- Tier 1: 5% fixed for the first 10 years, then variable at KIBOR + 3%

- Tier 2: 8% fixed for the first 10 years, then variable at KIBOR + 3%

What is the tenure of the financing?

The repayment period can be up to 20 years, depending on the applicant’s choice and eligibility.

How much down payment is required?

Customers need to pay at least 10% of the property value as their contribution.

Is this loan based on interest (Riba)?

No, this scheme is fully Shariah-compliant and follows the Diminishing Musharakah model, where ownership is gradually transferred to the customer.

Are there any hidden or extra charges?

No, Meezan Bank ensures transparent pricing. There are no processing charges, and other costs like valuation and legal fees are charged at actuals only.

How can I apply?

You can visit any Meezan Bank branch and request the Mera Ghar Mera Ashiana application form. Submit it with necessary documents, after which the bank will process and evaluate your application.