KPK Govt Loan Scheme 2025 for Interest-Free Qarza Complete Guide

The Khyber Pakhtunkhwa (KPK) government has launched an important initiative in 2025: the Interest-Free Qarza Scheme. This scheme aims to provide financial assistance to the people of KPK, helping them build better futures by supporting their economic ventures. Whether you’re looking to start a business, expand your current one, or meet urgent personal needs, this scheme could be a valuable resource. This article will explain the details of the KPK Govt Loan Scheme 2025, its eligibility criteria, the application process, benefits, and other details.

What is the KPK Govt Interest-Free Qarza Scheme 2025?

The KPK Interest-Free Qarza Scheme 2025 is a government initiative designed to provide interest-free loans to individuals and businesses in the province of KPK. This scheme is aimed at assisting those who do not have access to traditional financing methods due to financial constraints or lack of collateral.

The goal of this scheme is to promote economic development, create employment opportunities, and improve the quality of life for individuals in the region. The loan is intended to support small businesses, entrepreneurs, farmers, and students, enabling them to fulfill their financial needs without the burden of interest.

Key Features of the KPK Govt Loan Scheme 2025

Here are the key features of the KPK Government Interest-Free Qarza Scheme:

- Interest-Free Loans: The most attractive feature of this loan scheme is that it offers interest-free loans. Borrowers will not have to worry about repaying any additional amounts as interest, which makes it an ideal option for those struggling with high-interest rates from banks or other financial institutions.

- Flexible Loan Amounts: The loan amounts vary depending on the purpose of the loan. Whether you’re starting a small business, expanding an existing one, or funding a personal project, the KPK government provides financial support tailored to your specific needs.

- No Collateral Required: Many financial institutions require collateral to approve loans. However, under this scheme, no collateral is needed, making it accessible to those who may not have valuable assets to offer.

- Easy Repayment Terms: The KPK Government provides flexible repayment terms, making it easier for borrowers to repay the loan without putting undue stress on their finances.

- Targeted Support: The scheme prioritizes the following groups:

- Small businesses

- Entrepreneurs

- Farmers

- Students seeking education-related funding

- Women and minorities

Eligibility Criteria for the KPK Interest-Free Qarza Scheme 2025

Before applying for the loan, it is essential to meet the eligibility requirements set by the KPK Government. The criteria for eligibility are as follows:

- Age Limit: Applicants should be between the ages of 18 and 55 years.

- Residency: The applicant must be a permanent resident of Khyber Pakhtunkhwa.

- Income: The scheme is particularly designed for people with low to moderate income who struggle to access financial resources through traditional banking methods.

- Purpose of Loan: The loan must be used for business, agricultural, educational, or personal development purposes.

- Entrepreneurship: If you are applying for a business loan, the applicant should have a clear business plan with an identifiable product or service.

- Education Loans: Students must have an offer or admission letter from an accredited educational institution.

- Women and Minority Quotas: A certain percentage of the loans will be allocated specifically to women and minority groups to promote inclusivity.

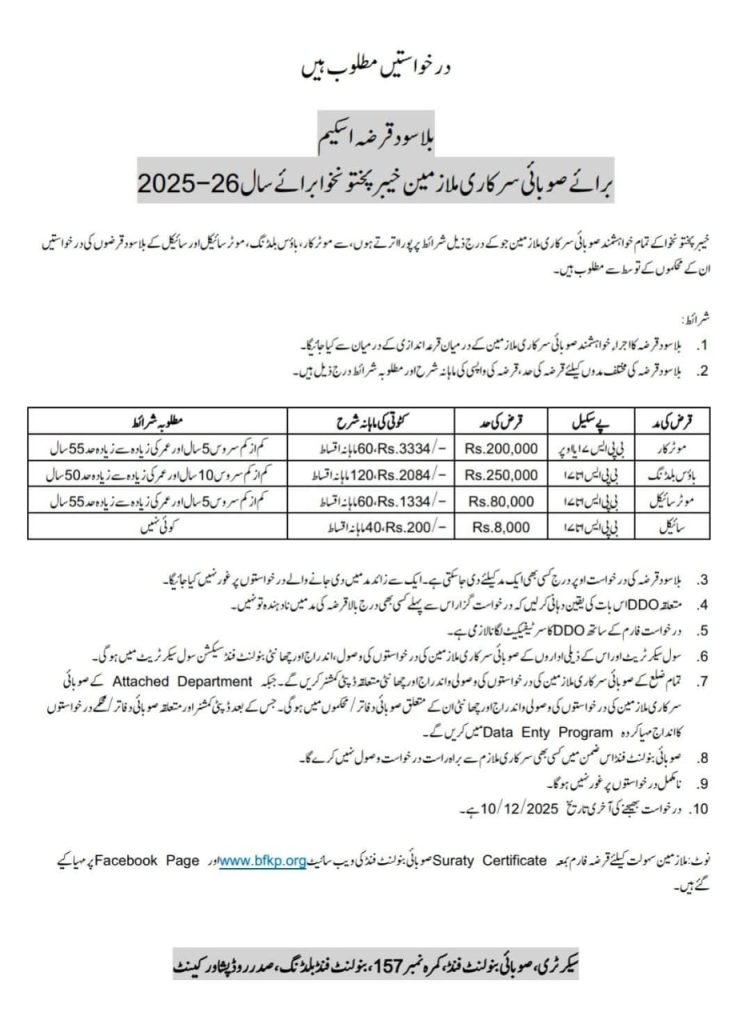

Loan Amount and Terms

The amount of money you can borrow through this scheme depends on the purpose for which the loan is being taken:

- Business Loans: Loans of up to PKR 250,000 are available to new and existing entrepreneurs.

- Agricultural Loans: Loans up to PKR 200,000 can be granted to farmers for the purchase of seeds, fertilizers, or to improve farm operations.

- Educational Loans: Students can apply for loans up to PKR 100,000 to fund tuition fees, books, or study-related expenses.

- Personal Loans: For emergency personal needs, loans up to PKR 80,000 are available.

Repayment terms will depend on the loan amount and type but generally range from 1 to 5 years.

How to Apply for the KPK Interest-Free Qarza Scheme 2025?

Applying for the KPK Govt Loan Scheme 2025 is a straightforward process. Here is a step-by-step guide to help you apply:

Step 1: Check Eligibility

Before applying, ensure that you meet the eligibility criteria. If you meet all the requirements, you can proceed to the next step.

Step 2: Gather Required Documents

The KPK Government requires certain documents to process the loan application. These may include:

- National Identity Card (CNIC)

- Proof of Residency in KPK

- Business Plan (if applicable)

- Admission Letter (for education loans)

- Income proof (if applicable)

Step 3: Submit the Application

You can apply for the loan either online through the KPK Government’s official portal or by visiting the designated offices in your district. Fill out the application form with your personal and financial details, and attach all required documents.

Step 4: Loan Approval Process

Once the application is submitted, the authorities will review it. They may ask for further documentation or clarification. Once approved, you will receive the loan amount in your bank account or in another specified manner.

Step 5: Loan Disbursement and Repayment

After approval, you will be informed about the disbursement of the loan amount. You will also be given a repayment schedule with detailed instructions on how to repay the loan.

Benefits of the KPK Interest-Free Qarza Scheme 2025

The KPK Government’s Interest-Free Qarza Scheme comes with numerous benefits:

- Economic Empowerment: By providing interest-free loans, this scheme empowers individuals and families to improve their standard of living and build better futures.

- Job Creation: Small businesses are more likely to succeed with proper funding, which can help create job opportunities in the region.

- No Interest Charges: The lack of interest means that borrowers only need to repay the amount they borrowed, making it affordable and more accessible.

- Support for Agriculture: Farmers can improve crop production, enhance their operations, and increase income without financial constraints.

- Educational Opportunities: Students can pursue their academic goals without worrying about tuition fees or other educational expenses.

Challenges and Considerations

While the scheme offers many advantages, there are some challenges to consider:

- Limited Loan Amount: The loan amounts may not be enough for large-scale businesses or significant investments.

- Eligibility Restrictions: Some people may not meet the criteria, especially those with high-income jobs or those who already have access to other financial resources.

- Application Process: Although the application process is straightforward, there might be delays in loan processing depending on the volume of applications.

Conclusion

The KPK Govt Interest-Free Qarza Scheme 2025 is a significant step toward empowering the people of Khyber Pakhtunkhwa, particularly those who face financial barriers to achieving their dreams. Whether you are an entrepreneur, farmer, student, or individual with personal needs, this scheme can help you access much-needed funds without the burden of interest. By following the simple application process and meeting the eligibility requirements, you can secure a loan that will pave the way for a brighter future.

FAQ’s

1. What is the KPK Interest-Free Qarza Scheme 2025?

A government program providing interest-free loans for business, education, and personal needs in KPK.

2. Who is eligible for this scheme?

Residents of KPK, aged 18 to 55, with low to moderate income.

3. How much can I borrow?

Loans range from PKR 80,000 to PKR 250,000, depending on the loan type.

4. Do I need collateral?

No, collateral is not required for this scheme.

5. What documents are needed?

- CNIC

- Proof of Residency

- Business Plan (if applicable)

- Admission Letter (for education loans)

6. How can I apply?

Apply online or visit the local government office with the required documents.

7. How will I receive the loan?

The loan will be disbursed to your bank account after approval.

8. What are the repayment terms?

Repayment depends on the loan amount and can range from 1 to 5 years.

9. Can I use the loan for personal expenses?

Yes, personal loans are available for various needs.

10. What is the last date to apply?

The application deadline is 10th December 2025.