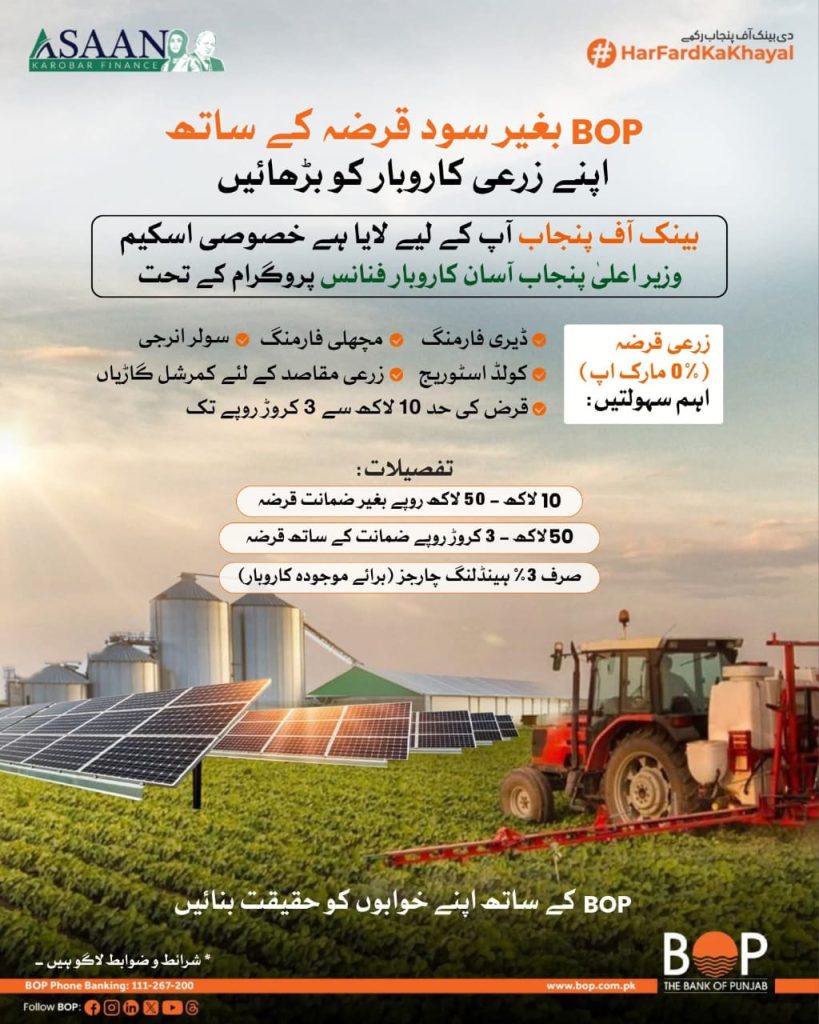

Bank of Punjab Asaan Karobar Finance Program Loan Scheme 2025 Registration Open

The Bank of Punjab (BOP) has introduced a special loan scheme under the Asaan Karobar Finance Program in 2025. The purpose of this scheme is to help farmers and small business owners grow their work without the burden of interest. This program comes with 0% markup loans and aims to support agriculture, livestock, solar energy, and other rural businesses across Punjab.

Why This Program Started

Many small farmers and agri-business owners face financial problems. They want to expand their work but cannot afford costly loans with heavy interest. The Punjab Government and BOP decided to make a program that gives interest-free loans. This will help farmers use modern technology, improve productivity, and increase income.

Who Can Apply

This loan scheme is for people who want to invest in agriculture and related businesses. Eligible applicants include:

- Dairy farming (milk production and dairy products)

- Fish farming (setting up ponds or expanding fish businesses)

- Solar energy projects (installing solar panels for farms or businesses)

- Cold storage facilities (for safe storage of fruits and vegetables)

- Agricultural machinery for commercial use (tractors, harvesters, etc.)

The program is designed to support both new and existing businesses.

Loan Amount and Conditions

The loan size depends on the type of borrower and the need.

- Rs. 10 Lakh to Rs. 50 Lakh: Without collateral (no property guarantee needed).

- Rs. 50 Lakh to Rs. 3 Crore: With collateral (property or asset guarantee required).

This flexible structure allows both small farmers and medium businesses to benefit.

Interest-Free Facility

The biggest benefit of this program is the 0% markup. This means borrowers will not pay any extra interest. They only need to return the actual amount borrowed. This is a huge relief compared to normal bank loans that charge heavy interest rates.

For existing businesses, there is a 3% processing charge. This is much lower than the usual costs in commercial loans.

Purpose of the Loan

The loan can be used for many purposes. For example:

- Expanding a dairy farm by buying more animals or machines.

- Building fish ponds for commercial fish farming.

- Installing solar panels to reduce electricity costs.

- Creating a cold storage facility to save crops from spoilage.

- Buying tractors, harvesters, or other farm equipment for large-scale use.

This helps farmers and entrepreneurs run their businesses with modern tools and methods.

Benefits of the Program

This scheme has many advantages for the people of Punjab:

- No interest burden – repay only the original loan amount.

- Support for new and existing businesses.

- Loans available up to Rs. 3 Crore for big projects.

- Special focus on agriculture and green energy.

- Easier access for small farmers with loans up to Rs. 50 Lakh without collateral.

Application Process

Applying for this scheme is simple. Interested people can:

- Visit any Bank of Punjab branch.

- Ask for the Asaan Karobar Finance Program loan form.

- Provide necessary documents like CNIC, proof of business, and in some cases property details.

- Submit the application for review.

- Once approved, the loan amount will be given as per need.

Applicants can also call the BOP Phone Banking helpline (111-267-200) for guidance. Details are also available on the official website www.bop.com.pk.

Example Case

Suppose a farmer wants to install a solar energy system on his land. He applies for Rs. 20 Lakh. The bank approves the loan without asking for collateral since the amount is under Rs. 50 Lakh. The farmer receives the money and installs solar panels. He saves electricity costs, earns more from his farm, and repays the loan without paying any markup.

Terms and Conditions

Like every loan scheme, there are some terms and conditions:

- Only Pakistani citizens can apply.

- Business must be in Punjab.

- Loan must be used for the stated purpose.

- Repayments must be made on time.

- Processing fee applies for existing businesses.

The Bank of Punjab Asaan Karobar Finance Program Loan Scheme 2025 is a major step to support farmers and small businesses in Punjab. By offering interest-free loans up to Rs. 3 Crore, the government and BOP are giving people a chance to grow without financial stress.

This program will not only increase the income of individuals but also help in developing the agriculture and energy sectors of the province. With BOP, people can now turn their dreams into reality.

FAQs – Bank of Punjab Asaan Karobar Finance Program Loan Scheme 2025

Q1: What is the Bank of Punjab Asaan Karobar Finance Program?

It is an interest-free loan scheme launched by the Bank of Punjab in 2025. The program is designed to support farmers and small businesses in Punjab by giving them easy access to loans without markup.

Q2: Who can apply for this loan scheme?

Farmers, agri-business owners, and entrepreneurs can apply. People working in dairy farming, fish farming, solar energy projects, cold storage, and agricultural machinery businesses are eligible.

Q3: What is the loan amount offered under this program?

You can get loans from Rs. 10 Lakh to Rs. 50 Lakh without collateral, and from Rs. 50 Lakh to Rs. 3 Crore with collateral.

Q4: Is there any interest or markup on this loan?

No. This is a 0% markup loan. Borrowers only return the amount they borrow, without paying extra interest.

Q5: Do I need collateral to get the loan?

For loans between Rs. 10 Lakh and Rs. 50 Lakh, you do not need collateral. For loans between Rs. 50 Lakh and Rs. 3 Crore, you must provide collateral.

Q6: What are the main benefits of this scheme?

- Interest-free loan up to Rs. 3 Crore.

- Easy access for small farmers with loans up to Rs. 50 Lakh without guarantee.

- Special support for agriculture and green energy projects.

- 3% processing charges for existing businesses only.

Q7: What can the loan be used for?

The loan can be used for expanding dairy farms, setting up fish farms, installing solar panels, building cold storage facilities, and buying agricultural machinery for commercial use.

Q8: How can I apply for this loan?

You can apply by visiting any Bank of Punjab branch. Fill out the loan application form, attach required documents, and submit it. You can also call the BOP helpline for details.

Q9: What documents are required?

Applicants usually need a CNIC, proof of business or farming activity, and collateral documents (if applying for a loan above Rs. 50 Lakh).

Q10: Where can I get more information?

You can call the BOP Phone Banking helpline (111-267-200) or visit the official website